- Education

- Trading CFDs

- What is CFD

What is CFD Trading - CFD Meaning

The main benefit of CFD trading is being able to speculate on price movements in both directions. Profit from trading CFDs exclusively lies on the trader's ability to correctly predict future price changes. Which is, no doubt, hard.

What is CFD Trading

CFD Trading is literally defined contract for difference trading means selling and buying CFDs. There are derivative contracts, because they allow you to speculate in the financial markets; forex, indices and commodities without ownership of the underlying assets. Before you continue reading about CFD Trading, you can read another article "What is Forex trading".

KEY TAKEAWAYS

- Contracts for difference (CFD) is a contract between a buyer and a seller that specifies that the buyer must pay the seller the difference between the current value of the asset and its value at the time of the contract.

- Trading CFDs offers several advantages that have made instruments so popular over the past decade.

- Trading CFDs allows traders to benefit from both rising and falling.

- Using stop-loss orders is probably the number one rule.

CFD Meaning

CFD (Contract for difference) is an agreement between two parties, “buyer” and “seller”, on paying each other the difference between the opening and closing prices of the traded instrument.

Contracts for difference lets traders profit from price movement without owning the asset. The CFD contract value does not take into account the underlying asset value: only the price change between entering and exiting a trade. In other words traders work with brokers without actually buying or selling any commodity, forex or stocks etc.

Trading CFDs offers several advantages that have made instruments so popular over the past decade.

How does CFD Trading Work

Now that we know what contracts for difference is, let’s see how it works. As we mentioned earlier, the investor does not actually own the asset, but instead receives profit from price change.

So when the investors want to trade gold CFDs, he or she will simply speculate on whether the price of gold will go up or down.

Basically, investors can use CFDs to bet on whether the price of an underlying asset rises or falls. Traders can bet on up or down movements.

- If a trader who has bought a CFD sees an increase in the price of an asset, he will put his share up for sale. The net difference between the purchase price and the sale price is deducted together. The net difference, representing the profit on trades, is calculated through the investor's brokerage account.

- On the other hand, if a trader thinks that the value of an asset will decrease, then an opening sell position can be placed. To close a position, a trader must buy a compensating trade. The net loss difference is then paid in cash through their account.

CFD Example

Trading CFDs allows traders to benefit from both rising and falling. It sounds a bit confusing, let us clarify, with examples.

Traders can take a short (sell) position, in hopes that the CFD price will fall and make a profit from it.

It might sound confusing, how are you going to make a profit if the price is falling, but the essence of CFDs, roughly speaking, is betting on price movement.

- Same goes with long (buy) position, traders can open long position, in hopes that CFD price will go up, and profit if the price actually goes up.

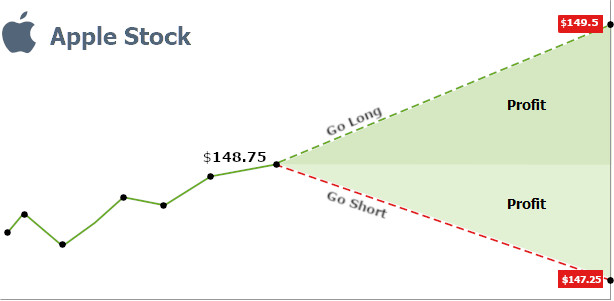

Let's take as an example Apple stocks, because who doesn't like apples. Current Apple stock share price is 148.75.

You, being a responsible trader, have done your homework (technical plus fundamental analysis) and decide

To go short, hoping on your analysis and pure luck, that AAPL CFDs will fall, let’s say, to 147.25. The sum of difference would be 1.5 (per share). If, for example, you decide to short CFD contract for 1000 Apple shares, your profit would be 1.5*1000, which equals $1,500.

To go long, again, hoping on your analysis and pure luck, that AAPL CFDs will rise, let’s say, to 149.5. The sum of difference would be 0.75 (per share), therefore, if you decide to go long CFD contract for 1000 Apple shares, your profit would be 0.75*1000, which equals $750.

* Note, in this example we are only showing the essence of trading CFDs. Leverage, commissions, stop loss orders are left out on purpose, so as not to load you with extra information.

CFD Trading Tips

To be frank, trading CFDs is not without risk, so newbies, please step aside and let experienced traders do their magic, while you learn. Meanwhile, we will share with you some CFD trading tips.

Use stop-loss orders - using stop-loss orders is probably the number one rule . Volatile markets are unpredictable, prices can drop or rise, and you will need to have safety in place. By safety in place we mean stop-loss orders.

But sometimes when prices fall or rise very quickly in big jumps, the price can plunge past your stop-loss level and, voilà, your position is closed at a much worse price than you intended.

To protect yourself from such situations, traders sometimes use guaranteed stop-losses. Some brokers do provide this kind of stop-loss orders, but not for free. Usually traders will have to pay an additional fee.

Limit your leverage - leverage is an enhancer of both gains and losses, keep that in mind. If the price even slightly moves in the opposite of your desired direction, after you opened the position, with leverage in place, you might be forced to close the position and won't be able to profit from it if the price bounces back.

Do your homework (technical and fundamental analysis) - first things, first, read research reports and articles on the stocks you are preparing to trade on. Conduct technical and fundamental analysis, don’t rely upon rumour.

Always keep enough cash in your account - trading positions will sometimes go against you, so it would be smart to not use all the cash you have, especially if you are using high leverage, ro in case you need to put up additional margin, because some brokers don't issue margin calls at all; they will simply liquidate some of your positions if you fall below margin requirements.

Diversify! All eggs in one basket never made anyone happy - First off, diversify, CFD trading gives you that opportunity. If you catch a bad break, it won't result in devastating bankruptcy. Remember CFDs are risky, mistakes are not a matter of if, but when.

The matter of the right CFD broker is a rule - To understand if you are trading with a good CFD broker, you will need to look into such important things like fees, because with frequent trading you're going to lose a big chunk of your profits on them.

So, what you need to pay attention to first is spread cost - difference between bid and ask prices. Choose wisely, so that spread doesn't eat your profit.

Next avoid scams, sounds obvious, but check their website, if they are licensed, bad reviews etc.

CFD Trading Explained

CFD imitates the profit and loss for real purchase or sale of an asset. The contract provides an opportunity for trading in the underlying market and make a profit without actually owning the asset.

Let us assume that you expect the rally in metals market to continue and you want to buy 1000 stocks of Freeport-McMoRan Copper & Gold Inc. (FCX), the world's largest publicly traded copper producer. You can buy these stocks through a broker paying a considerable portion (according to the regulatory norms of the Federal Reserve, the initial margin is currently 50% in the U.S.) of the total value of these stocks and take a leverage from the broker for the other part and, moreover, paying commission to the broker.

Instead, you can buy CFD contract for 1000 FCX stocks. To buy this contract you would have to make much lower margin deposit (2.5% of the total value of stocks provided by IFC Markets).

Trade with IFC MarketsTrading Stocks, Commodities, Indices and Currencies

A CFD (Contract for Difference) is a universal trading instrument, which has gained much popularity in the last years. With the help of CFDs, it has become possible to trade on the price movements of various financial instruments, without the need to possess them physically. Nowadays, CFDs allow to trade not only stocks but also major indices, currencies and commodities.

Trading on both Rising and Falling Markets

CFD is a flexible investment instrument. When you believe the market will rise you can make a profit by buying CFD which is known as going long. You can also speculate on falling prices by selling CFDs, known as going short. Holders of open buy positions on Stock CFD get a dividend adjustment equal to the announced dividend payment amount, if they have a long position open on the instrument at the beginning of trading session on the adjustment payment day (coincides with the ex-dividend date). In contrast, the dividend adjustment is deducted from customer's account in case of a short position.

Hedging the Investment Portfolio

If you believe that stocks you own are going to fall in price but still want to hold them, you can use the hedging strategy to protect your portfolio from risks by opening a short CFD position on your stocks portfolio. Your profits from going short in CFDs will reimburse the loss from the falling prices of the assets in your portfolio. You will carry lower transaction costs compared to hedging by selling the physical stocks in order to buy them back cheaper later.

Bottom line on What is CFD Trading

CFDs can be seen as an advanced trading strategy that is mostly used by experienced traders.

CFDs are high risk speculative derivatives that only sophisticated investors can use to place bets on what the price of the underlying security will be at some point in the future. It takes skill.

The benefits of CFD trading include lower margin requirements, easy access to global markets, no short or day trading rules, and little or no commissions. However high leverage increases losses when they occur, and having to pay the spread to enter and exit positions can be costly when there are no large price movements.

CFD trading instruments at IFCM

You can study CFD trading more thoroughly and see CFD trading examples in the section How To Trade CFDs Visit Educational Center

You can study CFD trading more thoroughly and see CFD trading examples in the section How To Trade CFDs Visit Educational Center Register with IFC Markets Now

Global Access to Financial Markets from a Single Account