- Education

- Trading CFDs

- CFD Markets

CFD Markets

In the world of finance and investing, CFD trading has gained immense popularity in recent years. CFD, which stands for Contract for Difference, is a financial instrument that allows traders to speculate on the price movements of various underlying assets without actually owning the assets themselves.

This article will provide an easy-to-understand overview of CFD markets, including different types of CFD instruments and popular CFD trading strategies.

Before diving into the details, let's outline the key takeaways of this article:

KEY TAKEAWAYS

- CFD trading is a popular method for speculating on price movements of various assets without owning them.

- CFD markets offer a wide range of instruments, including Forex, commodities, indices, stocks, and cryptocurrencies.

- Understanding the underlying assets and having a sound trading strategy are essential for successful CFD trading.

CFD Markets

CFD markets are financial platforms where traders can buy and sell CFD contracts based on the price movements of various underlying assets. These markets provide traders with access to a vast array of assets, making it possible to trade on global financial markets from the comfort of their own homes.

The beauty of CFD trading lies in the ability to profit from both rising and falling markets. When a trader believes the price of an asset will rise, they can take a long position (buy) on the CFD contract. Conversely, if they anticipate a price decline, they can take a short position (sell) on the CFD contract.

As with any form of trading, having a well-defined strategy is crucial for success in CFD markets.

CFD instruments

CFD markets offer a diverse range of instruments for traders to choose from. Let's explore some of the most popular CFD instruments and how they work.

Forex (foreign exchange) CFDs

Forex CFDs allow traders to speculate on the exchange rate movements between different currency pairs. For example, a trader can enter a CFD contract on the EUR/USD currency pair, speculating on whether the euro will strengthen or weaken against the US dollar.

Let's say that you believe that the EUR/USD exchange rate is going to rise in the near future. You can open a CFD contract to buy 100,000 EUR/USD. The chart below shows the EUR/USD exchange rate over the past few days.

As you can see, the EUR/USD exchange rate has been rising in recent days. If you had opened a CFD contract to buy EUR/USD at the start of the chart, you would have made a profit by the time you closed the contract.

The amount of profit you would have made would depend on the size of your contract and the amount that the EUR/USD exchange rate rose. For example, if you had opened a contract to buy 100,000 EUR/USD and the exchange rate rose from 1.1000 to 1.1200, you would have made a profit of 2000 EUR.

Of course, there is always the possibility of losing money when trading CFDs. If the EUR/USD exchange rate had fallen instead of rising, you would have made a loss.

This is just one example of how Forex CFDs can be used to speculate on the exchange rate movements between different currency pairs. It is important to understand the risks involved before you start trading CFDs.

Commodities CFDs

Commodities CFDs enable traders to speculate on the price movements of various commodities, such as gold, oil, silver, and agricultural products. Traders can take advantage of price fluctuations in these essential commodities without physically owning them.

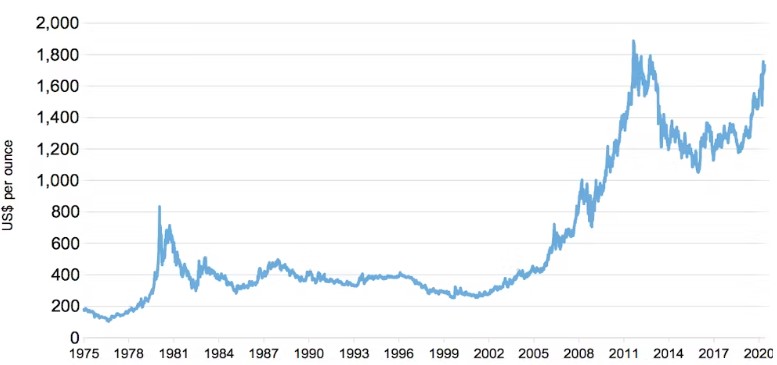

Let's say that you believe that the price of gold is going to rise in the near future. You can open a CFD contract to buy 100 ounces of gold. The chart below shows the price of gold over the past few days.

As you can see, the price of gold has been rising in recent days. If you had opened a CFD contract to buy gold at the start of the chart, you would have made a profit by the time you closed the contract.

The amount of profit you would have made would depend on the size of your contract and the amount that the price of gold rose. For example, if you had opened a contract to buy 100 ounces of gold and the price rose from $1800 to $1900, you would have made a profit of $1000.

Of course, there is always the possibility of losing money when trading CFDs. If the price of gold had fallen instead of rising, you would have made a loss. This is just one example of how Commodities CFDs can be used to speculate on the price movements of various commodities. It is important to understand the risks involved before you start trading CFDs.

Here are some other examples of Commodities CFD trades:

- Trader A believes that the price of oil is going to fall in the near future.

- Trader A opens a CFD contract to sell 1000 barrels of oil.

- The price of oil falls from $100 per barrel to $90 per barrel.

- Trader A closes the CFD contract and makes a profit of $10,000.

- Trader B believes that the price of silver is going to rise in the near future.

- Trader B opens a CFD contract to buy 5000 ounces of silver.

- The price of silver rises from $20 per ounce to $25 per ounce.

- Trader B closes the CFD contract and makes a profit of $25,000.

As you can see, Commodities CFDs allow traders to speculate on the price movements of various commodities. This can be a profitable way to trade the commodities market, but it is important to understand the risks involved before you start trading.

Indices CFDs

Indices CFDs represent the performance of a group of stocks that belong to a particular market or sector. Popular indices include the S&P 500, Dow Jones Industrial Average, and FTSE 100. By trading index CFDs, traders can gain exposure to the overall performance of a market without having to trade individual stocks.

Stock CFDs

Stock CFDs allow traders to speculate on the price movements of individual company stocks. It provides an opportunity to profit from the performance of well-known companies like Apple, Google, Amazon, and more, without owning the actual shares.

Cryptocurrency CFDs

Cryptocurrency CFDs have gained immense popularity as digital currencies like Bitcoin, Ethereum, and others have entered the mainstream. Traders can speculate on the price movements of cryptocurrencies without the need to store them in digital wallets.

As you can see, the price charts for these different types of CFDs can vary depending on the underlying asset. However, they all share some common features, such as the ability to track the price movements of the underlying asset over time.

It is important to note that these are just a few examples of price charts for CFDs. There are many other types of CFDs available, and the price charts for these assets will vary depending on the specific asset.

Bottom Line on CFD Markets

CFD trading offers a convenient and flexible way for traders to participate in various financial markets without physically owning the underlying assets. However, it's important to remember that CFD trading involves significant risks, including the potential for substantial losses.

To navigate the CFD markets successfully, traders must educate themselves on the underlying assets they are trading and develop sound trading strategies. It's also essential to manage risk effectively by using tools like stop-loss orders and proper position sizing.

In conclusion, CFD markets present exciting opportunities for both novice and experienced traders. With the right knowledge, skills, and discipline, traders can harness the potential of CFD trading to achieve their financial goals.

Always remember to trade responsibly and stay informed about the latest market developments to make informed decisions in this dynamic and fast-paced trading environment.