- PAMM accounts

- What is IFCM Invest

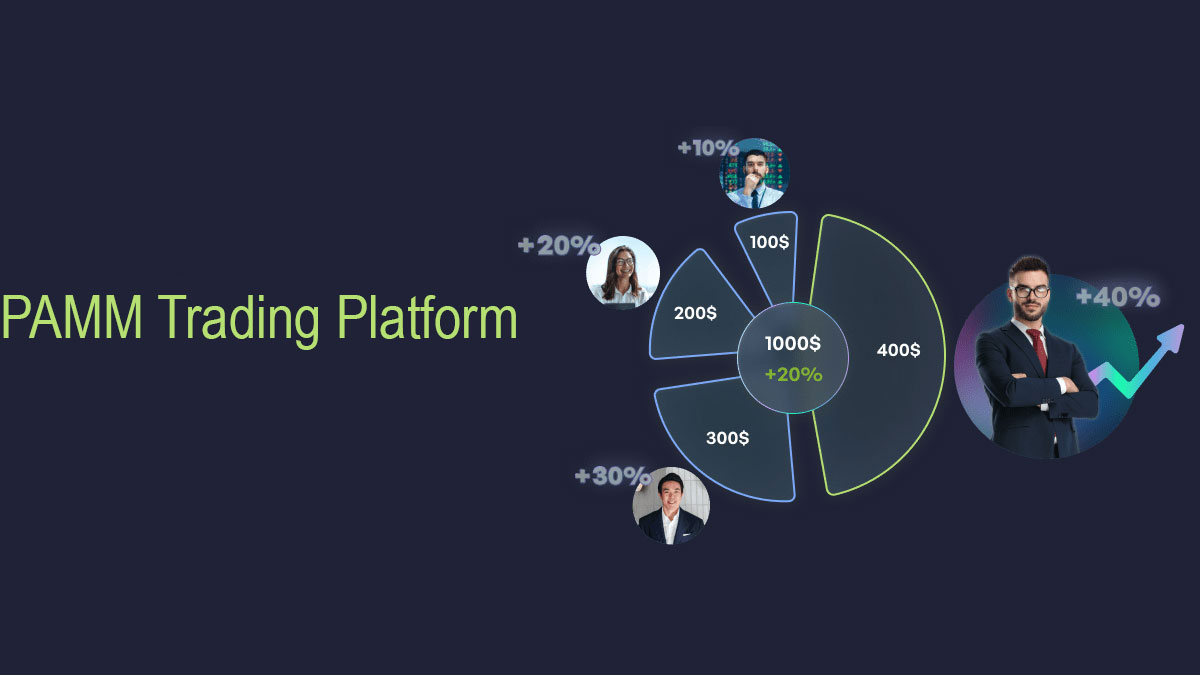

- PAMM Trading Platform

PAMM Trading Platform

PAMM (Percentage Allocation Management Module is a trading system that allows Investments) trading platform allows traders to create their own investment funds and scale success by receiving a percentage of profits or turnover fees as rewards from investors for their work.

Investors themselves cannot make trades, they only receive profit or loss from the master account in proportion to their investments. The platform can be used both with a rating of strategies for retail clients, and privately with unique distribution settings for each manager.

PAMM accounts are widely used by traders who have a money management license and who use capital intensive trading strategies that cannot be implemented on small accounts.

KEY TAKEAWAYS

- The investors are interested in gaining profits from Forex trading, but they either don't have time or don’t have sufficient knowledge to trade forex.

- Managers have expertise in trading and managing other people’s money, along with their individual trading capital. The Forex trading firm signs them up for managing other investors’ money.

- All PAMM platforms have their own ratings of the best traders, which allows investors to find a fund manager in the shortest possible time.

What is PAMM Trading Platform

PAMM (Percentage Allocation Management Module) is a form of Forex trading with combined money. An investor gets to allocate their money to the qualified traders/managers of their choice. Traders/managers in turn may manage multiple forex trading accounts using their own capital and pooled moneys, with an aim to generate profits.

To better understand what PAMM trading platform is let’s explore its main players:

In short

- Forex Broker - Provides a secure platform that allows managers and investors to interact and facilitates the trading activities of managers within allowed rules. The forex broker also allows investors to maintain accounts, make deposits, withdraw funds and perform related activities. In addition to the usual trading platform, it allows investors and managers to choose and interact with each other through transparent review, feedback, rating and related mechanisms.

- Investors - The investors are interested in gaining profits from forex trading, but they either don't have time or don’t have sufficient knowledge to trade forex.

- Mangers/traders - professional managers who have expertise in trading and managing other people’s money, along with their individual trading capital. The forex trading firm signs them up for managing other investors’ money.

PAMM accounts are a simple and convenient way for individuals to choose their money managers for Forex trading. With these accounts, investors make a profit with minimal participation.

However, PAMM accounts also carry the risk of capital loss depending on the efficiency of the money manager. Having understood the desired profit and risk potential, individuals should exercise due diligence when choosing a PAMM account broker and money manager.

PAMM Trading Platform Advantages

PAMM accounts have advantages to offer, let’s explore them:

- A financial account is opened on an independent platform that acts as a guarantor of funds for the trader and investor.

- The broker provides full access to the entire trading history, statistics of each manager and the current financial state of the account.

- Investors' investments can only be used for trading.

- A financial manager cannot independently withdraw the capital of another person.

- Good opportunities for risk diversification, in this case portfolio of traders (managers).

- The funds in the account can be divided equally among several traders, which avoids the loss of all funds due to the failure of one manager.

- The risk of capital loss is shared between investors and traders.

- Manager is required to deposit a decent amount of his own funds into the account.

- All PAMM platforms have their own ratings of the best traders, which allows investors to find a fund manager in the shortest possible time.

- Getting started with a broker does not require pre-agreed conditions. The investor just needs to read the terms and conditions of the platform and click the confirmation button.

Note: It is important not to forget that no matter how many positive aspects PAMM investing has, it is associated with risk, even the most experienced trader may not be insured against these risks, so when investing funds in an account, you must take this into account.

Bottom line on PAMM Trading Platform

A PAMM account is a very convenient product that allows investors to earn money without having to trade. You can invest your funds in traders' (managers) accounts, which receive as a reward a percentage of the profits received from trading with your funds.

In the end, I would like to remind you once again, The main rule of a successful investor is risk diversification. It is necessary to evenly distribute assets among several PAMM accounts using different trading strategies in order to minimize future monetary losses. Investing more than 40% of your capital in PAMM accounts would be an unwise decision.

The human factor in the investment process affects the risks associated with this financial asset. Despite the high profitability of this financial asset, it is considered quite risky.

Capital investment must necessarily be carried out in several different accounts, in which several managers are involved. This method of risk diversification effectively eliminates the human factor and does not expose all capital to the risk of any one factor.