- Analytics

- Technical Analysis

WTI Crude Oil Technical Analysis - WTI Crude Oil Trading: 2022-08-24

WTI Technical Analysis Summary

Above 94,5

Buy Stop

Below 84

Stop Loss

| Indicator | Signal |

| RSI | Buy |

| MACD | Buy |

| MA(200) | Neutral |

| Fractals | Neutral |

| Parabolic SAR | Buy |

WTI Chart Analysis

WTI Technical Analysis

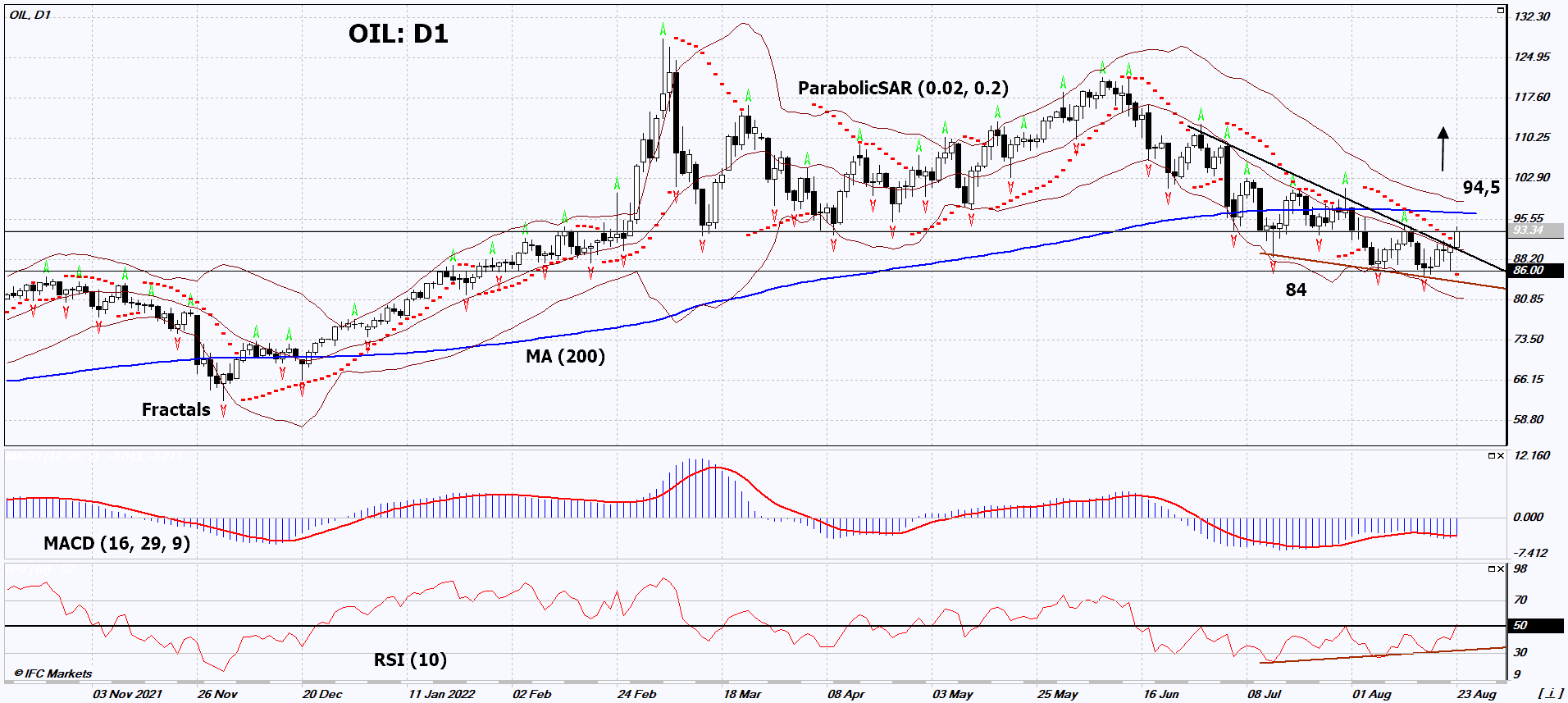

On the daily timeframe, OIL: D1 went up from the triangle. A number of technical analysis indicators formed signals for further growth. We do not rule out a bullish movement if OIL: D1 rises above the last up fractal: 94.5. This level can be used as an entry point. The initial risk limit is possible below the Parabolic signal and the last lower fractal: 84. After opening a pending order, we move the stop following the Bollinger and Parabolic signals to the next fractal low. Thus, we change the potential profit/loss ratio in our favor. The most cautious traders, after making a trade, can switch to a four-hour chart and set a stop loss, moving it in the direction of movement. If the price overcomes the stop level (84) without activating the order (94.5), it is recommended to delete the order: there are internal changes in the market that were not taken into account.

Fundamental Analysis of Commodities - WTI

OPEC+ may cut production if Iran increases oil production. Will the OIL quotes continue to increase ?

Opinion was expressed by Abdulaziz bin Salman (Minister of Energy of Saudi Arabia) regarding the information about a possible mitigation of Iran's demands (position) during negotiations with Western countries on the "nuclear deal". The next OPEC+ meeting is scheduled for September 5, 2022. It should be noted that OPEC+ production in July was already 2.89 million barrels per day (bpd) less than previously approved quotas. This was mainly due to Western economic sanctions against Russia. A significant factor in the rise in oil prices may be its use for heating and power generation in European countries against the backdrop of rising natural gas prices on August 22, 2022 to $3,000 per thousand cubic meters (according to the Title Transfer Facility).

Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.