- Analytics

- Technical Analysis

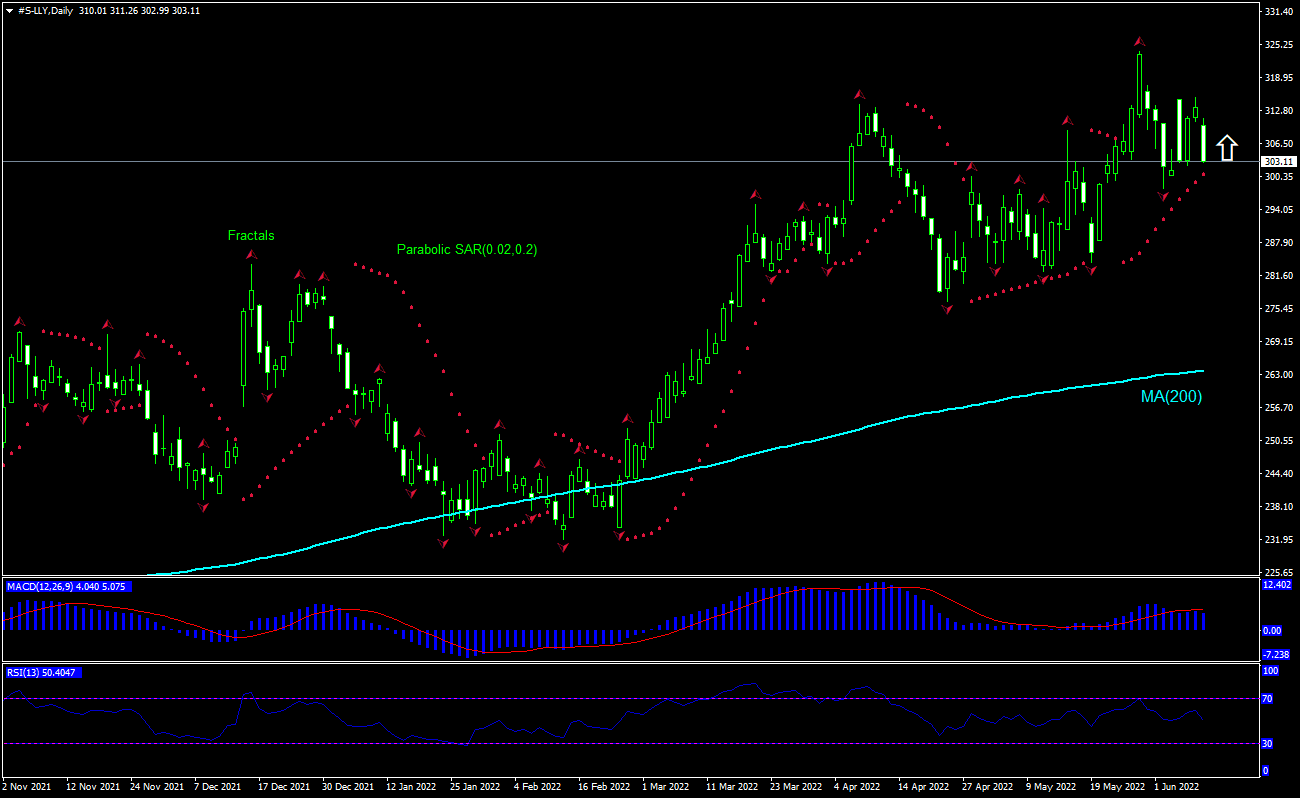

Eli Lilly Technical Analysis - Eli Lilly Trading: 2022-06-10

Eli Lilly Technical Analysis Summary

Above 323.99

Buy Stop

Below 298.07

Stop Loss

| Indicator | Signal |

| RSI | Neutral |

| MACD | Sell |

| MA(200) | Buy |

| Fractals | Buy |

| Parabolic SAR | Buy |

Eli Lilly Chart Analysis

Eli Lilly Technical Analysis

The technical analysis of the Eli Lilly stock price chart on daily timeframe shows #S-LLY, Daily is advancing above the 200-day moving average after multiple tests of the MA(200) in the beginning of 2022. We believe the bullish momentum will continue after the price breaches above the fractal high at 323.99. This level can be used as an entry point for placing a pending order to buy. The stop loss can be placed below the fractal low at 298.07. After placing the order, the stop loss is to be moved every day to the next fractal low, following Parabolic indicator signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (298.07) without reaching the order (323.99), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Fundamental Analysis of Stocks - Eli Lilly

Eli Lilly’s former employee sued the company over drug manufacturing problems on Monday. Will the Eli Lilly stock price continue rebounding?

Eli Lilly’s former human resources officer sued the drug maker alleging she was terminated after pointing out poor manufacturing practices and data falsification involving one of its blockbuster diabetes drugs. Amrit Mula alleges in the lawsuit that she repeatedly pressured the company starting in 2018 to remedy manufacturing violations involving several biologic drugs, including type 2 diabetes medicine Trulicity. The US Department of Justice last year launched a criminal investigation into alleged manufacturing irregularities at an Eli Lilly plant in New Jersey following officer’s allegations. US Food and Drug Administration cited the problems in 2020 as "Official Action Indicated," which is its most serious category of violation. Ely Lilly in a statement on Tuesday called Mula's allegations "baseless" and said it "looks forward to the opportunity to defend itself in court." The stock price closed up 0.6% on the day after the lawsuit news.

Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.