- Analytics

- Technical Analysis

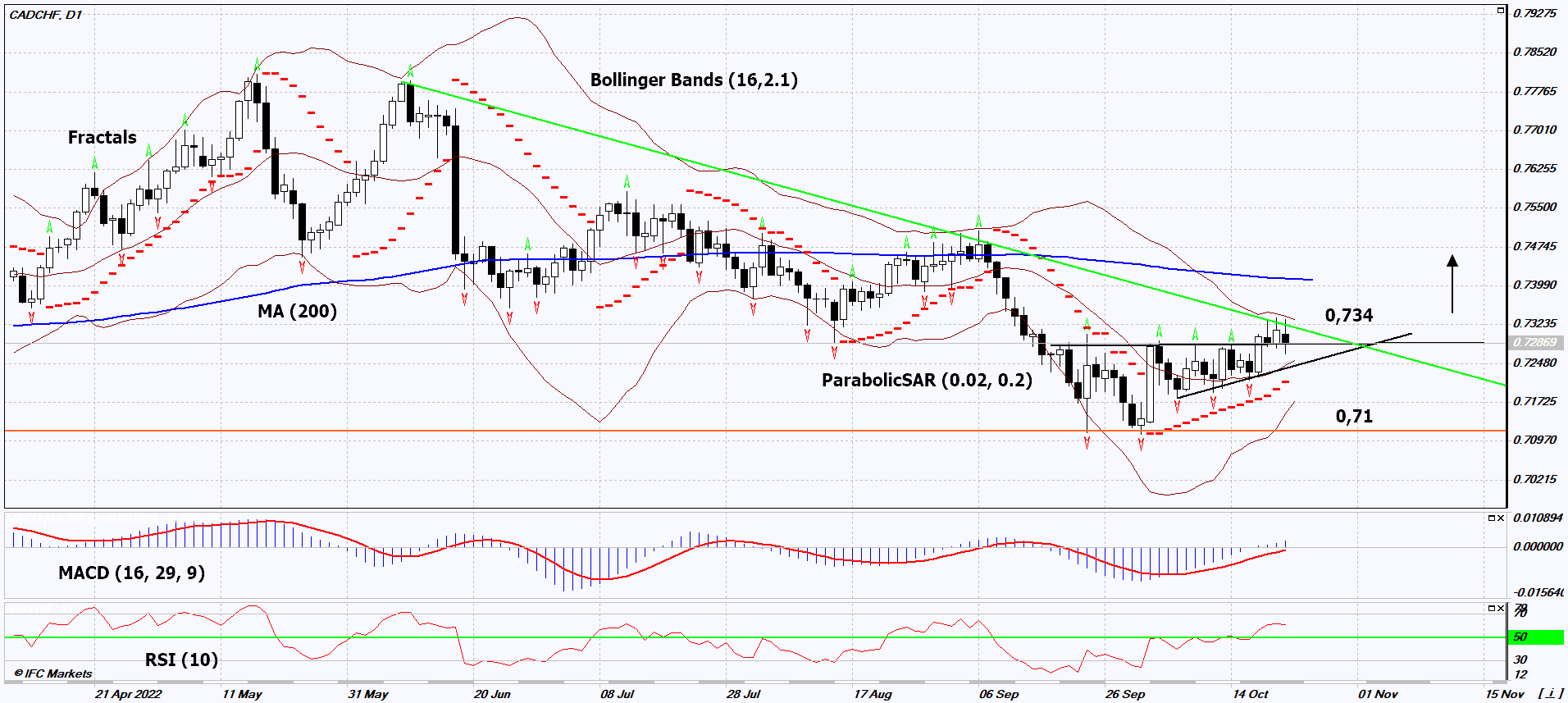

CAD/CHF Technical Analysis - CAD/CHF Trading: 2022-10-25

CAD/CHF Technical Analysis Summary

Above 0,734

Buy Stop

Below 0,71

Stop Loss

| Indicator | Signal |

| RSI | Neutral |

| MACD | Buy |

| MA(200) | Neutral |

| Fractals | Buy |

| Parabolic SAR | Buy |

| Bollinger Bands | Neutral |

CAD/CHF Chart Analysis

CAD/CHF Technical Analysis

On daily timeframe, CADCHF: D1 moved up from triangle and got closer to downtrend line of resistance. It should be pierced upwards before opening a position. Some technical analysis indicators show signals to further rising. We do not exclude bullish movement, if CADCHF: D1 will rise above the upper Bollinger band and its last maximum: 0,734. This level can be used as entrance point. The first risk limitation can be placed lower than Parabolic signal and lower Bollinger band, the last 4 fractals and the minimum from 2021: 0,71. After placing pending order, we should move the stop levels along with Bollinger and Parabolic signals to the next fractal minimum. Thus we can change prospective profit/loss level to our own benefit. The most careful traders can switch to 4 hours timeframe and place the stop-loss moving it along the price direction. If the price overcomes stop level (0,71), without activation of order (0,734), an order is recommended to be deleted: the market is facing internal changes that were not taken into account.

Fundamental Analysis of Forex - CAD/CHF

The next meeting of Bank of Canada (BoC) is going to happen on October 26th. Will CADCHF quotes continue to rise?

Investors are waiting BoC interest rate rises to 4% from current level of 3,25%. It is driven by a slow decrease of Canadian inflation to annual 6,9% in September from 40 years maximum in June (annual 8,1%). Canada Gross Domestic Product for August will be published in October. These data can inflict on Canadian dollar price dynamics. KOF Switzerland Economic Barometer economical indicator is going to be published on October 28 as well. Следующее заседание The next Swiss National Bank (SNB) will be held not soon - on 15th of December. Its interest rate is 0.5% with inflation level of annual 3.3% It is noteable that the interest rate was negative from the end of 2014. It is difficult to say if SNB is going to tighten its monetary policy in future. According to its forecast, inflation level in Switzerland will be slightly higher than 3% all year, will be decreased to 2,4% in 2023 and will be decreased to annual 1,7% in 2024.

Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.