- Education

- Introduction to Trading

- What is a Trading Signal

What is a Trading Signal

Trading signals are alerts or indications that provide traders with information about potentially profitable trading opportunities. These signals can be generated by a variety of sources, such as technical indicators, news events, or expert analysis, and are typically delivered through a variety of mediums, such as email, SMS, or trading platforms.

The purpose of trading signals is to help you make more informed trading decisions. Trading signals are providing you with actionable information that can be used to enter or exit trades.

For example, a trading signal may indicate that a particular currency pair is likely to rise in value, prompting you to buy that pair in anticipation of a profit.

There are many different types of trading signals available, to choose and use a combination of signals to inform their trading decisions. Some traders rely heavily on signals, while others use them as a supplementary tool in their trading strategy.

It's important to note that while trading signals can be helpful in identifying potential trading opportunities, they are not foolproof and should be used in conjunction with other forms of analysis and risk management techniques.

KEY TAKEAWAYS

- Trade signals are triggers for buying or selling securities based on a predefined set of criteria.

- They can also be used for portfolio rebalancing and changing sector distribution or opening new positions.

- Traders can create trade signals using a variety of criteria, from simple ones such as earnings reports and volume growth to more complex signals derived from existing signals.

What is a Trading Signal

Trading signals are recommendations on profitable buying and selling points for currency pairs, indices, cryptocurrencies, etc., compiled based on detailed analysis. This information is disseminated through specialized platforms, channels, chats, and messengers, which can be either open or closed. The former are available to everyone, while the latter are only accessible to those who have paid a subscription fee.

Each service has its own approach to analyzing the situation in the financial market. Some use technical analysis, others fundamental analysis, and still others have insider information. In all three cases, probability plays a big role because trading signals do not guarantee traders a 100% result.

How Trading Signals Work

Trade signals can incorporate various inputs from different fields of study. Typically, technical analysis plays a major role, but fundamental analysis, quantitative analysis, economics, sentiment measures, and even signals from other trade signal systems can also be used. The objective is to provide investors and traders with a mechanical method, free from emotion, for buying or selling a security or other asset.

Apart from simple buy and sell triggers, trade signals can also help in modifying a portfolio by identifying when it may be advantageous to purchase more of a particular sector, such as technology, and reduce holdings in another sector, such as consumer staples. Bond traders may use signals to adjust the duration of their portfolios by selling one maturity and buying a different maturity.

Lastly, trade signals can aid in asset class allocation, such as shifting investments between stocks, bonds, and gold.

The complexity of a trade signal is limitless, but traders often prefer to keep things simple by using only a few inputs. For practical reasons, it is much easier to manage a simple signal generator and periodically evaluate it to identify components that require adjustment or replacement.

Too many inputs can increase complexity and demand more time than a trader can offer. Also, since markets are dynamic and often change quickly, complex strategies could become obsolete before testing is even completed.

Example of Trading Signal

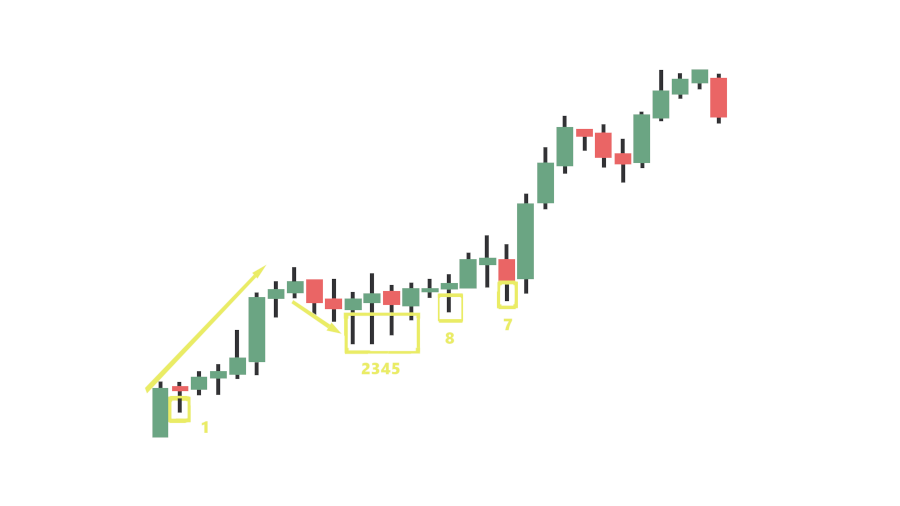

The first signal appeared in a very good place and quickly went into profit. After a clear impulsive movement, a power correction occurred, during which the 2nd, 3rd, 4th, and 5th signals appeared in a row, then the 6th signal appeared after four hours, and the last 7th signal appeared after 8 hours, after which the chart made another impulsive upward movement. Such a series of excellent opportunities to enter the market with the trend occurs extremely rarely - and none of them would have resulted in a loss with competent position management.

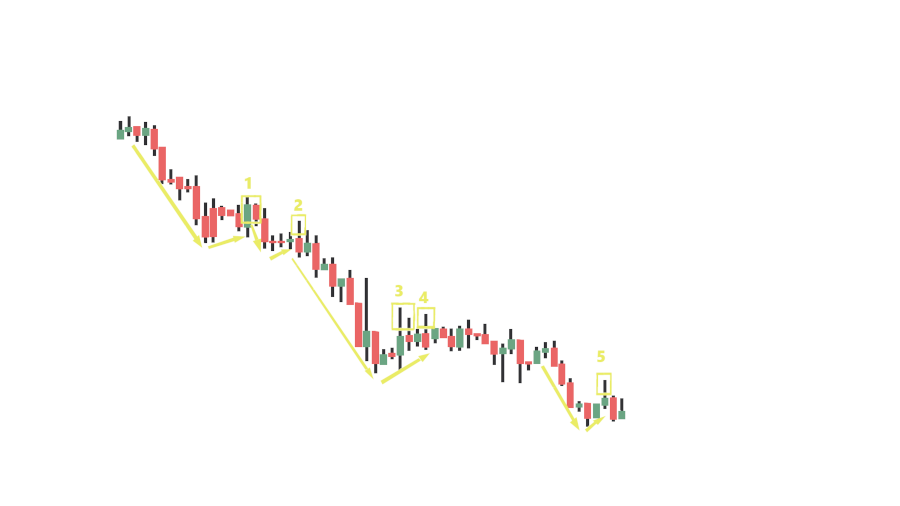

The first signal could have occurred after a confident drop in price, although the rebound itself may not appeal to everyone. The second signal is very good, as it occurred after a very shallow correction, and the Pin Bar did not break through the Tenkan Sen too strongly, indicating its strength as a resistance. The remaining three signals follow the same logic.

Trading signals are typically associated with fast-paced trading. However, some signals are less frequent and are based on the rise and fall of stock purchases.

Good trading signals of this type would be to look for periods when price action does not match fundamental indicators. An example would be a situation where the market is selling off due to fear headlines, but fundamental data indicates good health. Traders may decide to buy on the dip if their signal shows a "good deal".

When a trading signal comes, there are infinite possibilities, but traders typically just want to automate their thinking. An example could be, "buy for a stock with a price-to-earnings ratio below a certain level (P/E ratio) when a certain technical formation breaks upwards, and prices are above a certain moving average, while interest rates are falling".

Here are some of the most common inputs. Traders can combine them as they wish to match any criteria they use to select trades.

Breakout or Technical Pattern Breakout

These may include triangles, rectangles, head and shoulders, and trendlines.

Crossing of the Moving Average

Most investors track the 50-day and 200-day moving averages, but there are other widely used ones. The entry may be when trading activity crosses above or below the average. Or it could be when two averages cross.

Volume Spike

Unusually high volume often heralds a new move in the market. Open interest can also be used in futures markets.

Interest Rates

Changes in rates can often indicate changes in stock and commodity markets.

Volatility

There are many ways to measure volatility, and as with other indicators, extreme highs or lows in volatility can trigger market changes.

Cycles

Markets of all types tend to ebb and flow over time, even if they are in a stable trend or non-trending state. One of the most widely known cycles is the seasonal cycle for stocks - sell in May and go away - which can help determine whether a strategy works in the strong or weak half of the year.

Mood Extremes

Using excessive bullish sentiment as a contrary indicator, according to polls or actual trading activity, can indicate market tops. And conversely, excessive bearish sentiment can lead to market bottoms.

Valuation

Excessive valuation compared to market, industry, or specific stock metrics can lead to sell-offs.

Automated vs Normal Trading Signals

Automated trading signals are generated by computer algorithms that are designed to identify potential trade opportunities based on predetermined criteria, such as technical indicators, market trends, or news events. These signals are usually delivered to traders in real-time via email, text message, or through a trading platform.

Normal trading signals, on the other hand, are generated by human traders or analysts who use their experience and knowledge to identify potential trade opportunities based on market analysis.

Advantages of Automated Trading Signals

Speed and Efficiency

Automated trading signals can be delivered in real-time, allowing traders to act quickly on potential trade opportunities.

Objectivity

Automated signals are generated based on predetermined criteria, eliminating the potential for human bias or emotion to affect trading decisions.

Consistency

Automated signals are generated consistently, without any variations due to human factors such as mood or fatigue.

Backtesting

Automated signals can be backtested on market historical data, allowing traders to evaluate the effectiveness of the signals before using them in live trading.

Disadvantages of Automated Trading Signals

Lack of Flexibility

Automated signals are based on predetermined criteria and may not be able to adapt to changing market conditions.

Over-Reliance

Traders who rely solely on automated signals may become too dependent on them and miss potential trade opportunities that fall outside the criteria of the signal.

Technical Issues

Automated signals rely on technology, which can be vulnerable to technical issues such as power outages, internet connectivity problems, or system failures.

False Signals

Automated signals may generate false signals, leading traders to take positions that may not be profitable.

Advantages of Normal Trading Signals

Flexibility

Human traders can adapt to changing market conditions and adjust their trading strategies accordingly.

Intuition

Human traders may be able to identify potential trade opportunities based on intuition or experience that may not be captured by automated signals.

Decision-making

Human traders can make subjective decisions based on their analysis and judgment, which may be beneficial in certain situations.

Personalization

Human traders can tailor their trading signals to their personal preferences and trading styles.

Disadvantages of Normal Trading Signals

Emotions

Human traders may be susceptible to emotions such as fear or greed, which can lead to poor trading decisions.

Inconsistency

Human traders may make different decisions based on their mood, fatigue, or other factors, leading to inconsistency in their trading signals.

Time-consuming

Human traders may require more time to analyze market data and generate trading signals, which may be a disadvantage in fast-moving markets.

Bias

Human traders may have biases based on their personal experiences, education, or culture, which may affect their trading decisions.

Bottom Line of What is trading Signals

Trading signals as alerts provide traders with information about potentially profitable trading opportunities.

These signals can be generated by a variety of sources, such as technical indicators, news events, or expert analysis, and are typically delivered through various mediums, such as email, SMS, or trading platforms.

The purpose of trading signals is to help traders make more informed trading decisions. However, the article cautions that while trading signals can be helpful in identifying potential trading opportunities, they are not foolproof and should be used in conjunction with other forms of analysis and risk management techniques.

You have also learned how trade signals work, their benefits, and their limitations, examples of different inputs that traders can use to create trade signals.

Finally, trading signals, though are quite helpful, you have to remember, they aren't 100% bulletproof.