- Education

- About Forex

- How to Trade Forex in South Africa Step by Step

How to Trade Forex in South Africa Step by Step

Forex trading has become increasingly popular among retail investors in recent years, with the advent of online trading platforms and low minimum deposit requirements.

However, many beginners are often intimidated by the complexity of the forex market and are unsure of how to get started. In this article, we will provide a step-by-step guide on how to trade forex using an example to help beginners understand the process.

What is Forex Trading

Forex trading, also known as foreign exchange trading, is the buying and selling of currencies in order to make a profit from the fluctuation in exchange rates. The forex market is the largest financial market in the world, with an average daily turnover of around $7.45 trillion.

In forex trading, traders speculate on the value of one currency against another.

For example, if you believe that the value of the euro will rise against the US dollar, you would buy euros and sell US dollars. If your prediction is correct and the euro does indeed rise in value, you can sell the euros for a profit.

To trade Forex, it is important to understand the basic terminologies used in the market. Here are some of the most important terms:

- Currency pair: Two currencies that are traded against each other, e.g. EUR/USD (euro versus US dollar).

- Bid price: The price at which a buyer is willing to purchase a currency pair.

- Ask price: The price at which a seller is willing to sell a currency pair.

- Spread: The difference between the bid and ask price.

- Pips: The smallest unit of measure in a currency pair, usually the fourth decimal place (e.g. 0.0001).

Types of Forex Trading Accounts

Before starting to trade Forex, you will need to open a forex trading account with a broker. There are several types of forex trading accounts available.

For example IFC Markets has to offer these trading accounts, you can study them carefully via this link - Trading Account Types, or check out these tables below.

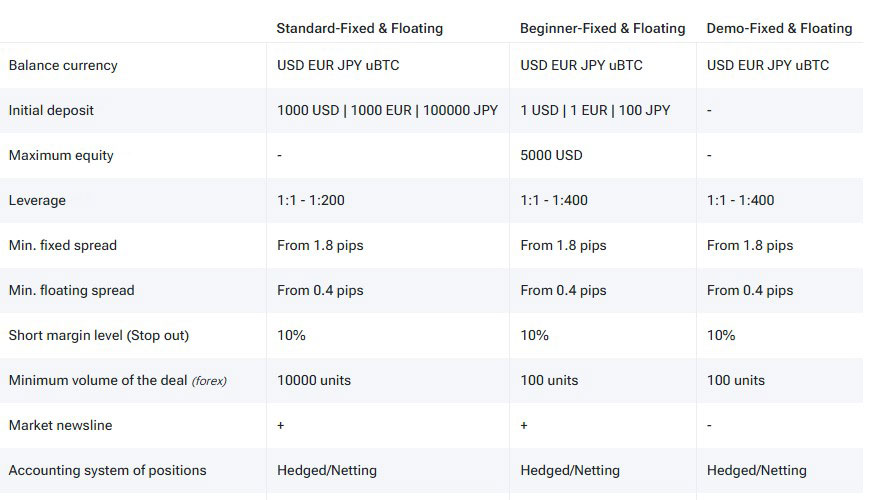

NetTradeX Trading Account Types

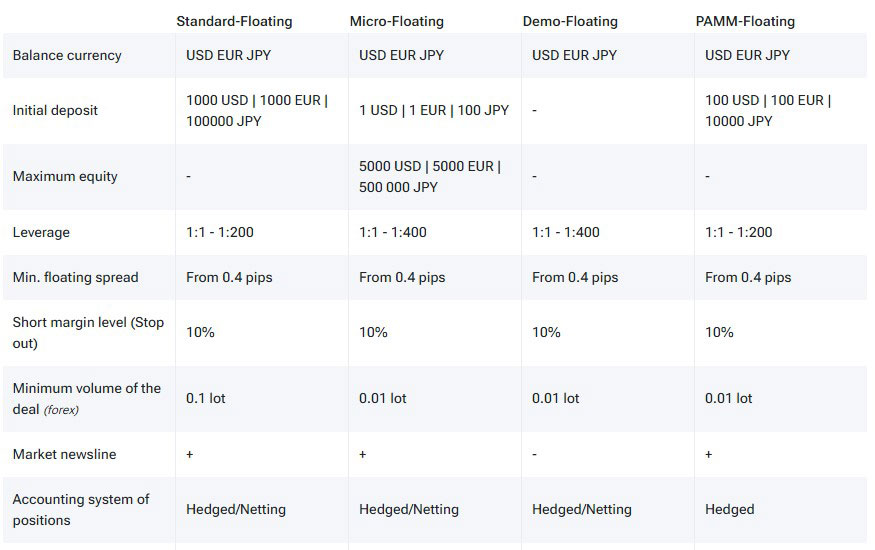

MT4 trading Account Types

MT5 trading Account Types

We suggest you start from a free Demo account, it will save your money and serve to build a better understanding of forex trading.

How to Set Up a Forex Trading Account

To open a forex trading account, you will need to follow these steps:

To open a Real or Demo Account, follow these steps:

- Go to your Profile and navigate to the "My Accounts" section on your Dashboard.

- Click either the "Open Live Account" or "Open Demo Account" button.

- Select the Platform you want to use: NetTradeX, MetaTrader 4, or MetaTrader 5.

- Choose the Account Type based on your preferred trading conditions. There are different account types for each platform, such as Beginner, Standard, or Demo, and also accounts with Fixed or Floating spreads.

- Select the Leverage you want to use.

- Choose the Account Currency you prefer.

- For Demo accounts, you can set the amount of virtual account balance you need.

- Confirm that you have read and agree to the documents on the terms of trade.

- Click the "Open Account" button.

Note that you can own multiple accounts on each platform, but each account must differ from the others by at least one parameter, such as account type or currency. Once you open a new account, you will receive an email with your account number and password. You can view all your Live and Demo accounts, including the new one, in the "My Accounts" section of your Private Area.

What are Forex Trading Platforms

A forex trading platform is a software application that will allow you to access the forex market and place trades. There are many trading platforms available, each with its own features and advantages. Some of the most popular trading platforms include

- NetTradeX - IFC Markets own trading platform, we invite you to check it out, hope you like it.

- MetaTrader 4,

- MetaTrader 5,

- cTrader,

- TradingView

There are a few obvious steps you will need to take to set up a forex trading account. If you’re aware of them, you can just jump to the next heading.

To use a trading platform, you will need to download and install the software on your computer or mobile device. Once you have installed the platform, you will need to log in to your trading account using your account credentials.

The trading platform will provide you with a variety of tools and features to help you analyze the market and place trades. Some of the most important features of a trading platform include:

- Charting tools։ These tools allow you to analyze price movements and identify trends in the market.

- IndicatorsTechnical indicators provide traders with additional information about the market, such as momentum, trend strength, and volatility.

- Order types: The trading platform will allow you to place different types of orders, such as market orders, limit orders, and stop-loss orders.

- Position sizing: The platform will allow you to adjust the size of your trades based on your account balance and risk tolerance.

- Trading history: The platform will keep a record of all your trades and provide you with detailed reports and analysis.

Fundamental and Technical Analysis

The cornerstone of professional trading is well-done fundamental and technical analysis. There is no way without them, and we note that both have their role, so if you think that if there is technical analysis, you can no longer pay attention to fundamental analysis, or vice versa, it will be a mistake, especially when you are just beginning to know the Forex world.

Let us give you a brief introduction to technical and fundamental analysis.

Fundamental Analysis

Fundamental analysis is the process of analyzing economic and financial data to determine the value of a currency. Fundamental factors that can affect currency values include interest rates, economic growth, inflation, and geopolitical events.

To perform fundamental analysis, traders will need to keep up to date with the latest news and economic data releases from around the world. Economic calendars and news feeds are available on most trading platforms and provide traders with real-time updates on economic events.

Traders can use fundamental analysis to identify potential trading opportunities by analyzing how economic data releases and news events affect currency values. For example, if the US Federal Reserve announces an interest rate hike, this could cause the US dollar to strengthen against other currencies.

Technical Snalysis

Technical analysis is the process of analyzing price movements and chart patterns to identify potential trading opportunities. Technical analysts use charts and indicators to identify trends, support and resistance levels, and other patterns that can provide insights into market behavior.

To perform technical analysis, traders will need to use charting tools and technical indicators. There are many different types of indicators available, including trend indicators, oscillators, and volume indicators. Traders can use technical analysis to identify potential entry and exit points for their trades.

How to Place a Forex Trade

To place a forex trade, you will need to

- Choose a currency pair: Decide which currency pair you want to trade and analyze the market using fundamental and technical analysis.

- Decide on your trade direction (trend, sentiment): Based on your analysis, decide whether you want to go long (buy) or short (sell).

- Set your trade size: Decide how much you want to trade based on your risk tolerance and account balance. Don’t forget the rule of 1% (you should never risk more than 1% of your account value on a single trade).

- Place your trade: Enter the trade details into the trading platform, including the currency pair, trade direction, trade size, and any stop-loss or take-profit orders.

- Monitor your trade: Keep an eye on your trade and adjust your position as necessary based on market conditions.

It sounds simple, but such thoughts will cost you money. The Forex market is volatile, and even if you follow all the rules, it does not guarantee 100% profit, not even close. First try trading using a Demo account.

What is Risk Management

Risk management is an important part of forex trading, as it helps to minimize the potential losses that you will incur. Here are some tips for managing risk in forex trading:

- Use stop-loss orders: it automatically closes your trade if the market moves against you, limiting your potential losses.

- Use proper position sizing: Only risk a small percentage of your account balance on each trade, typically no more than 2-3%. As we previously mentioned a rule of 1%, some see 2-3% as acceptable risk as well.

- Use a trading strategy: A trading strategy is a set of rules and guidelines that are established in advance and used to make decisions about buying and selling assets in financial markets. These rules and guidelines will help you make informed and consistent decisions about when to enter or exit trades.

- Keep emotions at bay: Avoid letting emotions such as fear and greed dictate your trading decisions.

Bottom Line on Step by Step Guide on How to Trade Forex

Forex trading can be a profitable and exciting way to invest your money, but it is important to approach it with caution and a solid understanding of the market. By following the steps outlined in this article, you can learn how to trade forex.

Remember to start small and only risk what you can afford to lose. As you gain experience and confidence, you can gradually increase your trade sizes and take on more risk.

Always keep an eye on market conditions and be prepared to adjust your trading strategy as necessary. And most importantly, never stop learning. The forex market is constantly evolving, so it is important to stay up to date with the latest news and market developments.